- Get link

- X

- Other Apps

Does Annual Income Include Student Loans, Getting A Mortgage While On Income Based Repayment Ibr

Does annual income include student loans Indeed lately is being hunted by users around us, maybe one of you personally. Individuals now are accustomed to using the internet in gadgets to view image and video data for inspiration, and according to the name of the post I will talk about about Does Annual Income Include Student Loans.

- I M Calling For Something Truly Transformational Universal Free Public College And Cancellation Of Student Loan Debt By Team Warren Medium

- U S Average Student Loan Debt Statistics In 2019 Credit Com

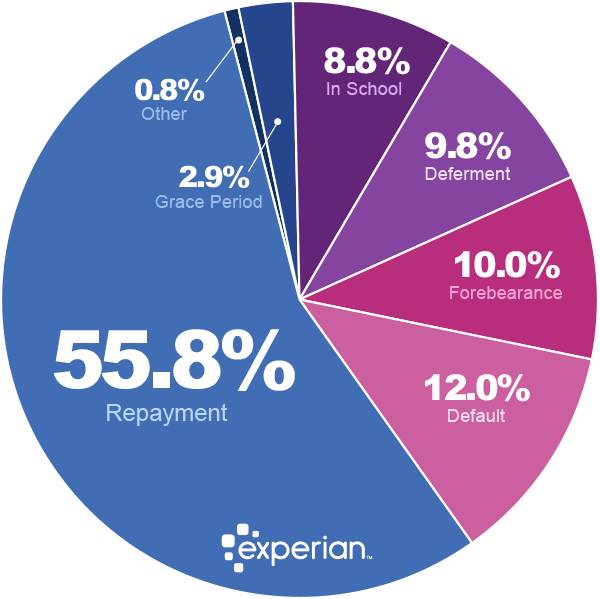

- Should You Use Your Student Loans To Pay Off Credit Cards Experian

- How To Pay Off Student Loans Fast Daveramsey Com

- Does The Student Loan Burden Weigh Into The Decision To Start A Family Pdf Free Download

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn And9gcr0narure09owbdpbrca4milo24ot9hbcw2maflsrdqs7okehbb Usqp Cau

- 5 Facts About Student Loans Pew Research Center

- Price Of College Increasing Almost 8 Times Faster Than Wages

- Your 1098 E And Your Student Loan Tax Information

Find, Read, And Discover Does Annual Income Include Student Loans, Such Us:

- Top 5 Questions About Subsidized And Unsubsidized Loans Ed Gov Blog

- Does The Student Loan Burden Weigh Into The Decision To Start A Family Pdf Free Download

- Student Loan Refinancing And Consolidation Wells Fargo

- Do Student Loans Count As Income We Explain When They Do And Don T

- Student Debt Wikipedia

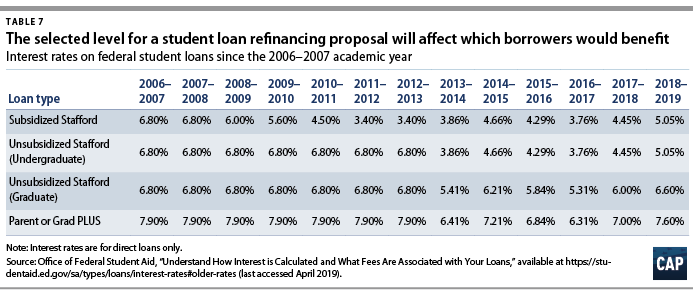

- Beware Of Student Loan Interest Rates Or You Ll Pay For It Student Loan Hero

- How To Get A Private Student Loan Forbes Advisor

- Bad Credit Mortgage Loans In Alabama

- Quick Title Loans Online

- Low Interest Car Loans For Disabled

- Currently In Default On Student Loans

- Payday Loans No Brokers No Credit Checks No Fees

- Hitachi Capital Loans Phone Number

- Gogo Loans

This is true whether your loans are federally insured or commercially issued. No because its a loan. C h e a p c h r i s t m a s 1 5.

does annual income include student loans

If you are searching for Gogo Loans you've reached the right location. We have 104 graphics about gogo loans including images, pictures, photos, wallpapers, and more. In these webpage, we also have number of images out there. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, transparent, etc.

Student loans are not included as a source of income susan stawick a spokesperson for the federal reserve board told dailyfinance theres nothing specific in the law or in the staff.

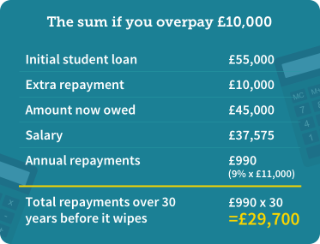

Gogo loans. Benefits of student loans if you have a large amount of student loans dont panic or worry that it will damage your credit or keep you from future financial freedom. The irs does not consider student loans to be income and you do not have to report them as income on your federal income taxes. In fact if you make payments on your student loans you may be eligible for a deduction on your federal income taxes for the interest you paid on your student loans during the previous year.

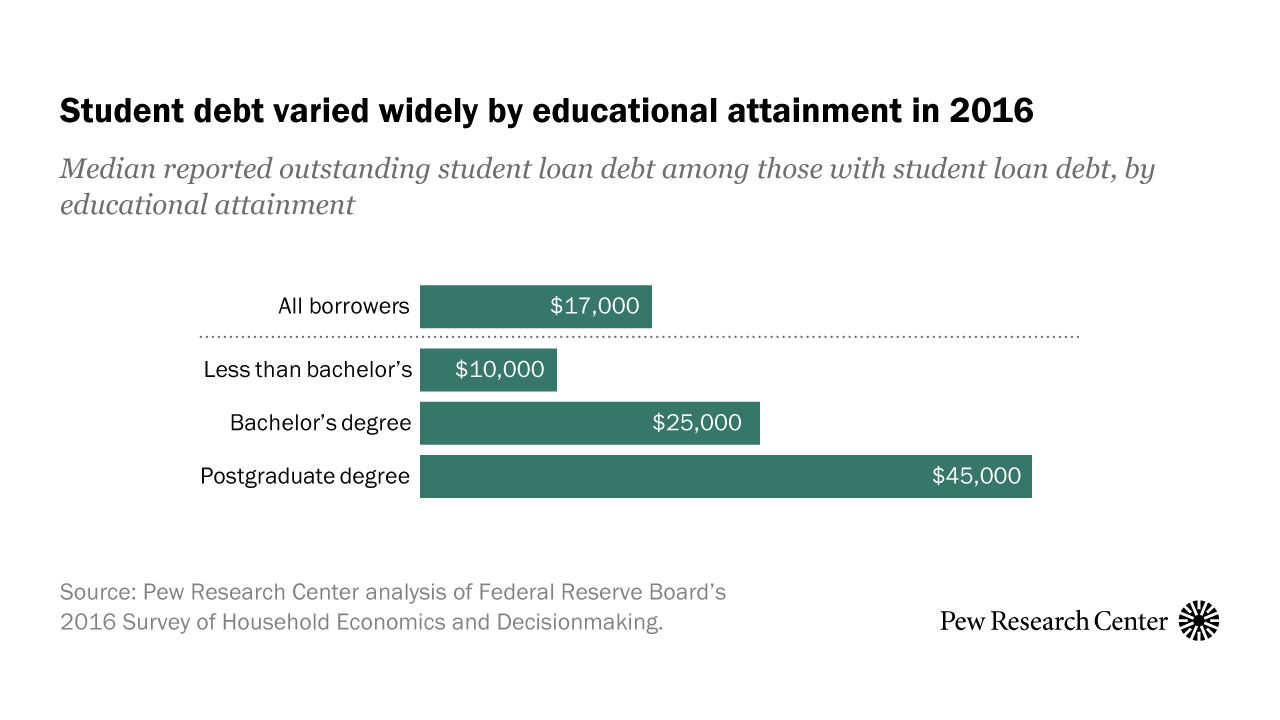

A students annual income for credit card applications should include the funds from student loans. The maximum maintenance loan is 12010 and is paid to students who will be living away from home and in london and whose annual household income is below 25000. However student loans could affect your taxes after you graduate and enter the repayment phase.

I didnt think any full time student could claim benefits. And for more info on student loans in england check out this guide. Are forgiven student loans considered taxable income.

Personally i think its a bad idea. Others dont allow it at all. Some issuers do permit student loans to be included as income as long as the funds can be withdrawn on a regular basis for living expenses.

I had to come off is as my student loan is classed as income. I get a grand total of 379 a month which im assuming stops in may when uni finishes. Instead student loans are seen as debt which must be repaid while scholarships grants and work study income can be counted as qualified income.

Csa1 does income include student loans and grants. Money that you must pay back in the future is debt. Stop claiming it interestingly when we were mortgage hunting hsbc wouldnt include my loan as income and the guy printed me off a copy of their regs and put a not on my file that he had given them to us mad.

Income and family size. Living simply not simply living. Having your student loans forgiven may seem like an all around great idea.

An individuals annual income is compared to their family size and a maximum monthly payment is derived from those two numbers. The ibr plan takes two main factors into consideration when determining how much an individual can afford on their college loan payments. The irs does not consider student loan proceeds or refunds as income on your tax return in the year that your college receives the funding.

But similarly to the irs credit issuerslike banks and online lendersdont consider student loans as income.

More From Gogo Loans

- Are Discharged Student Loans Taxable

- Condo Loans For Bad Credit

- Bad Credit Auto Loans Nova Scotia

- Gaap Accounting For Forgivable Loans

- Quick Cash Loans For Students

- Branch Loans Kenya

- Poor Credit Card Loans

Incoming Search Terms:

- Your 1098 E And Your Student Loan Tax Information Poor Credit Card Loans,

- What Could Happen If The Government Wiped Out Student Debt Npr Poor Credit Card Loans,

- Student Loan Refinance Calculator Should I Refinance Nerdwallet Poor Credit Card Loans,

- Orthodontist Salary Is It Worth The Student Debt Student Loan Planner Poor Credit Card Loans,

- Income Driven Repayment Options Poor Credit Card Loans,

- For More Details Please Visit Our Site Educational Funding Company 4 Poor Credit Card Loans,

- Your Discretionary Income Student Loans How One Impacts The Other Student Loan Hero Poor Credit Card Loans,

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn And9gcrwhb81rli3hgphmae8mtfkq6pf Gjjw7qqw3frnjze7k C2wm1 Usqp Cau Poor Credit Card Loans,

- Managing Your Student Loans During Covid 19 Poor Credit Card Loans,

- Get link

- X

- Other Apps