- Get link

- X

- Other Apps

Do You Report Personal Loans On Taxes, Personal Loan Calculator Student Loan Hero

Do you report personal loans on taxes Indeed lately is being hunted by users around us, perhaps one of you. Individuals now are accustomed to using the internet in gadgets to see video and image data for inspiration, and according to the name of this post I will discuss about Do You Report Personal Loans On Taxes.

- Hdfc Personal Loan 10 75 Interest Rate Eligibility Apply Online

- Do Personal Loans Affect Your Tax Return Loanry

- 2

- How To Use A Personal Loan To Pay Your Tax Bill Bankrate Com

- Publication 936 2019 Home Mortgage Interest Deduction Internal Revenue Service

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn And9gcqo Tftncvwdddgjrqwiks4eosioshwytroytuvwcecrfy8ppww Usqp Cau

- Best Personal Loans Of 2020 U S News

- Payday Loans Vs Personal Loans What S The Difference Earnest

- Personal Loan Calculator 2020 Calculate Your Monthly Payment Smartasset Com

Find, Read, And Discover Do You Report Personal Loans On Taxes, Such Us:

- Family Loans Do Loans Count As Income Are Taxable

- Paying Tax On Personal Loans Sofi

- Sbi Pnb And Union Bank Among Those Offering The Lowest Interest Rates On Personal Loans

- Axis Bank Personal Loan Customer Care 24x7 Toll Free Number

- What To Do If Your Loan Application Is Rejected

- Personal Loan What Is A Personal Loan Here S A Guide

- Personal Loans Compare Top Online Lenders Now Nerdwallet

- How Do You Know If You Owe Student Loans

- Home Improvement Loans Dallas

- Flight School Loans Uk

- Liberty Credit Union Loans

- Logbook Loans No Phone Calls

- Edmed Student Loans

- Are Sofi Loans Safe

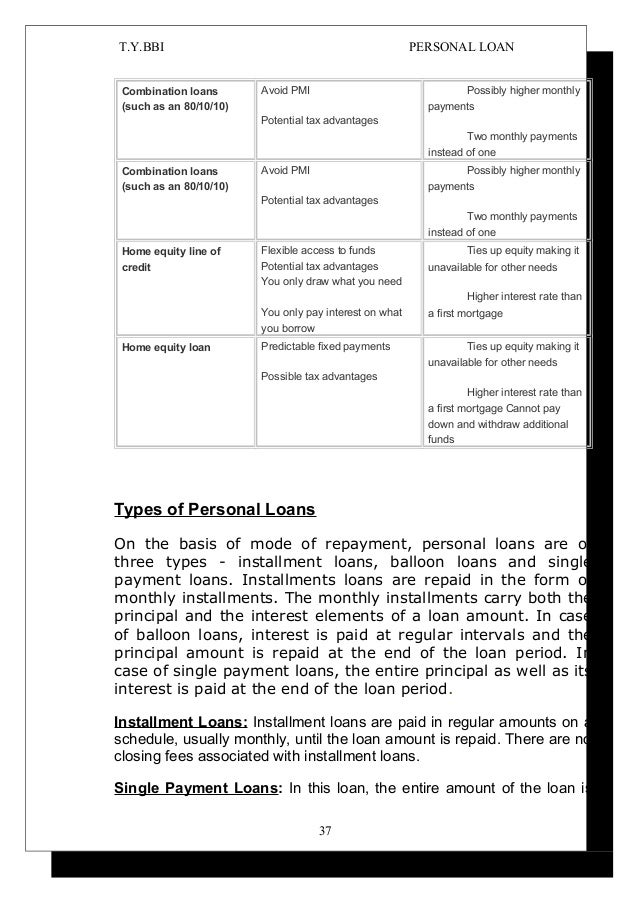

The reason its important to ensure you report your student loan payments correctly on your taxes is to ensure youre paying the correct amount and no more than you need to. If this is a personal loan the interest income is entered as if you have received form 1099 int. Enter your individuals name as a payers name and the amount of interest received in box 1.

do you report personal loans on taxes

If you are looking for Are Sofi Loans Safe you've reached the perfect location. We ve got 104 images about are sofi loans safe including images, pictures, photos, wallpapers, and more. In these webpage, we additionally provide number of graphics out there. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, transparent, etc.

Do not offset interest expense against interest income.

Are sofi loans safe. Use this to document any interest you receive that is not reported to you on a 1099 int. Tax benefits with personal loans. In most cases however this isnt a big deal as the unpaid interest can be treated as a tax free gift from the lender to the borrower.

How to report student loans on your tax return student loans arent counted as income on your taxes and they arent taxable. Add the total of all interest received on personal loans and report in on line 8a of form 1040. The answer is no with one significant exception.

When you take a personal loan the loan amount is not earned income. If you borrow to buy a car for personal use or to cover other personal expenses the interest you pay on that loan does not reduce your tax. Are personal loans considered taxable income.

Loans are temporary and once youve paid them back with interest you havent grown your wealth or income with that money. Interest enter taxable interest on us. Report interest of less than 1500 on line 8a without a schedule b.

In other words you cannot be taxed on loan proceeds unless. Use schedule b if your total of all interest not just personal loans is more than 1500. Obligations and on loans notes mortgages bonds bank deposits corporate bonds tax refunds etc.

Interest paid on personal loans is not tax deductible. Personal loans dont always play into your taxes. The indian income tax act allows tax deductions on loans for specific purposes like education purchase or renovation of your house business expansion etc.

No personal loans arent considered taxable income in most situations. Personal loans do come with tax benefits depending on the end use of the loan amount. Student loan and tuition tax forms.

Personal loans are not considered income for the borrower unless the loan is forgiven. Where on the tax return do you report interest on a corporate loan to shareholders. You can learn more about below market loans by reading irs publication 550.

How personal loan can provide you tax benefits. Since the lender is required to report the interest as taxable income this could create some tax issues. But in the few situations where it counts as income or if your interest payments are tax deductible you need to report it.

You do not owe taxes on a personal loan unless that loan is forgiven or cancelled before youve paid it back in full.

More From Are Sofi Loans Safe

- How To Debt Consolidation Loans

- Elton John Quicken Loans Arena 2019

- Can You Have Multiple Loans

- Loans El Centro Ca

- Native American Bank Loans

- Auto Loans For Teachers With Bad Credit

- Bank Of America Home Loans Simi Valley Ca 93065

Incoming Search Terms:

- Itr 1 Filing How To File Itr 1 With Salary Home Loan And Other Income For Fy 2018 19 Bank Of America Home Loans Simi Valley Ca 93065,

- Best Personal Loans Of 2020 U S News Bank Of America Home Loans Simi Valley Ca 93065,

- Is Personal Loan Interest Tax Deductible Experian Bank Of America Home Loans Simi Valley Ca 93065,

- Axis Bank Personal Loan Customer Care 24x7 Toll Free Number Bank Of America Home Loans Simi Valley Ca 93065,

- Pin On Best Sample Report Template Bank Of America Home Loans Simi Valley Ca 93065,

- Are Personal Loans Taxable Discover Bank Of America Home Loans Simi Valley Ca 93065,

- Pin On Personal Loans Online Bank Of America Home Loans Simi Valley Ca 93065,

- Best Personal Loans In Malaysia 2020 Compare And Apply Online Bank Of America Home Loans Simi Valley Ca 93065,

- Sjdcb1ot2jrkam Bank Of America Home Loans Simi Valley Ca 93065,

- Get link

- X

- Other Apps

/prosper-00b97b5f6a844937a0c354916e7af35c.png)