- Get link

- X

- Other Apps

Can Installment Loans Garnish Wages, 6 Ways To Stop Student Loan Wage Garnishment Student Loan Hero

Can installment loans garnish wages Indeed recently is being hunted by consumers around us, maybe one of you. People are now accustomed to using the internet in gadgets to view video and image information for inspiration, and according to the title of the post I will discuss about Can Installment Loans Garnish Wages.

- Millions Of Americans Wages Seized Over Credit Card And Medical Debt Npr

- Pin On Favorites Misc

- Unsecured Personal Loan Options And How They Work By Tom Que Issuu

- How Student Loan Wage Garnishment Guts Your Paycheck Nerdwallet

- Payday Loans And Wage Garnishment What You Need To Know Opploans

- Https Www Nj Gov Oal Decisions Final Pdf Hea 2007162 14 20james 20dougherty 20v 20new 20jersey 20higher 20education 20student 20assistance 20authority Pdf

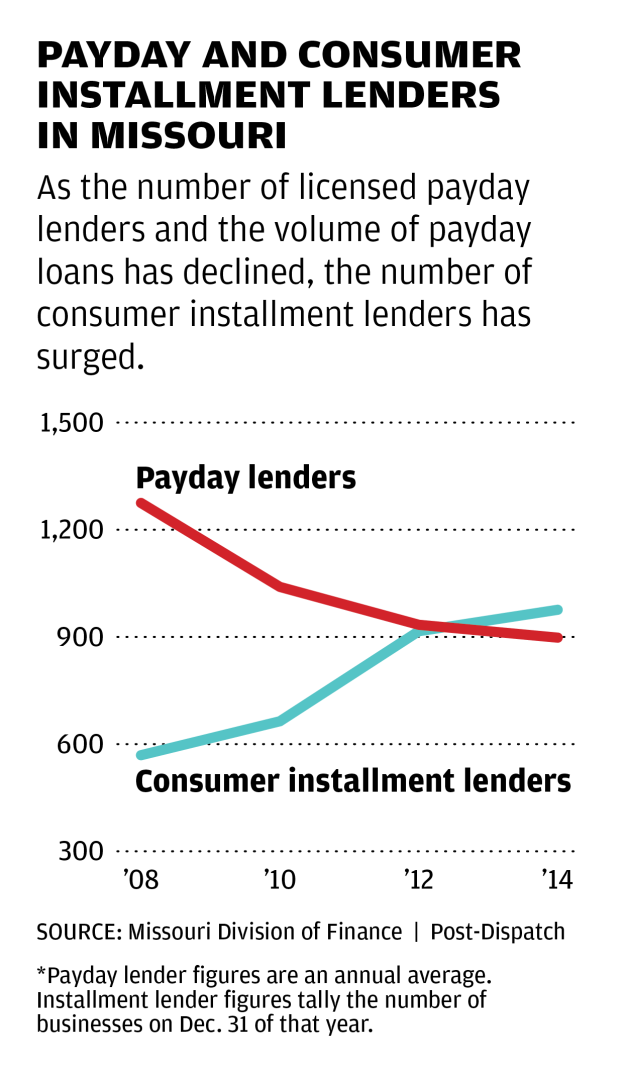

- She Borrowed 100 And Paid Back 3 592 Local Business Stltoday Com

- 4 Best Online Installment Loans For 2020 Lendedu

- Can A Payday Loan Garnish Your Wages

Find, Read, And Discover Can Installment Loans Garnish Wages, Such Us:

- How To Stop Wage Garnishment Due To My Student Debt

- Qphtensam3f9ym

- Can Your Social Security Benefits Be Garnished To Pay A Debt

- Repaying A Loan What To Do When You Can T Make A Payment Stumble Forward

- Unable To Pay The Irs

- Can A Payday Lender Garnish Your Wages

- Wage Garnishment What Employers Need To Know Under The Cares Act Workest

- Coastal Bend Loans Corpus Christi

- Car Loans Chennai Tamil Nadu

- Income Based Repayments For Student Loans

- Federal Student Loans Nslds

- No Down Payment Home Loans Oklahoma

- Does Carmax Buy Cars With Title Loans

- Car Title Loans Rolla Mo

Federal loans can garnish your wages after you default. When requesting an installment payment plan you must detail your income and expenses to the court. I had a ca internet installment loan through checkngo in 2006 and a someone from an attorneys office called my job stating they were garnishing my wages.

can installment loans garnish wages

If you are searching for Car Title Loans Rolla Mo you've arrived at the right location. We ve got 102 graphics about car title loans rolla mo adding pictures, pictures, photos, wallpapers, and much more. In these web page, we additionally have variety of images out there. Such as png, jpg, animated gifs, pic art, symbol, black and white, transparent, etc.

If youre wondering whether you can negotiate the simple answer is yes you can.

Car title loans rolla mo. Your employer is then required to withhold the amount garnished and forward it to your lender. If they win or if you do not dispute the lawsuit or claim the court will enter an order or judgment against you. A payday lender can only garnish your wages if it has a court order resulting from a lawsuit against you.

First contact your creditors and explain your situation. Wage garnishment can make it difficult or impossible to live comfortably reducing the amount you are able to spend on essentials like food and toiletries utilities and bills or supporting your family. Debt consolidation forums payday loan help forums can checkngo garnish wages.

Although federal student loans offer a nine month period before your loan goes into default the us. Basically it may take a private lender or a debt collector years after you stop making your monthly payments before it sues you. If you dont repay your loan the payday lender or a debt collector generally can sue you to collect.

For private creditors the act sets a limit on wage garnishment of up to 25 of disposable earnings or up to the amount that your earnings are greater than 30 times the federal minimum hourly wage. Before you call review your budget so you know how much you can offer to pay. Private student loans can garnish your wages only after they file a lawsuit against you and get a court order authorizing them to start garnishing your wages.

See if you can work out a settlement or payment plan. Typically theyll start garnishing your wages a few months after you default. Department of education can garnish your wages without a court order.

Before that happens however you should get notice of the proposed wage garnishment. You default on a federal student loan after you miss 9 monthly payments. In nonwage garnishment commonly referred to as a bank levy creditors can.

The amount that can be garnished is limited to 25 percent of the borrowers disposable earnings or what is left after mandatory deductions or the amount by which your weekly wages exceed thirty times the minimum wage whichever is lower. In wage garnishment creditors can legally require your employer to hand over part of your earnings to pay off your debts. Another option is to challenge the court order.

More From Car Title Loans Rolla Mo

- Hard Money Real Estate Loans Phoenix

- Quick Loans For Bad Credit And Unemployed

- Payday Loans On Coursey

- Fast Easy Loans South Africa

- Best Subprime Car Loans

- Quicken Loans Arena Cavaliers Store

- Harp For Non Freddie And Fannie Loans

Incoming Search Terms:

- Student Loan Garnishment Student Loans Help With Irs Relief Harp For Non Freddie And Fannie Loans,

- The Wages Of Millions Are Being Seized To Pay Past Debts Pacific Standard Harp For Non Freddie And Fannie Loans,

- What Happens When You Can T Repay A Payday Loan Nerdwallet Harp For Non Freddie And Fannie Loans,

- Can A Payday Loan Company Take You To Court Harp For Non Freddie And Fannie Loans,

- 1 Harp For Non Freddie And Fannie Loans,

- Loan Despite Negative Credit Bureau And Garnishment Of Wages Antoniusschoolnieuwvennep Nl Harp For Non Freddie And Fannie Loans,

- Installment Loans Are No Answer To Financial Hardship Southwest Ledger Harp For Non Freddie And Fannie Loans,

- What Happens When You Default On A Loan Harp For Non Freddie And Fannie Loans,

- 4 Best Online Installment Loans For 2020 Lendedu Harp For Non Freddie And Fannie Loans,

- Get link

- X

- Other Apps