- Get link

- X

- Other Apps

Claiming Student Loans On Income Tax, Claiming Your Student Loan Interest Deduction And Other Tax Tips Student Loan Hero

Claiming student loans on income tax Indeed lately is being hunted by consumers around us, maybe one of you personally. Individuals now are accustomed to using the internet in gadgets to see image and video information for inspiration, and according to the name of this article I will discuss about Claiming Student Loans On Income Tax.

- How Can You Claim Student Loan Interest On Your Income Tax Return Howstuffworks

- Here S How Your Student Loans Can Get You A Tax Break

- Student Loan Repayment Student Loan Tax Tips For 2019

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn And9gctnksu1wkyndbghyghnd3ezseffntdo Ww Ab1ioiivm50lp7kj Usqp Cau

- 7 Important Tax Facts Every Student Needs To Know Save The Student

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn And9gcsorv Hiidvnxjg0n3b36juzwlfk3ycvpg A Ej1fbfiux0wu50 Usqp Cau

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn And9gcsd2jis L29c8rn3e92 Laez15rkyoiww 3pwkggw9ismyzknln Usqp Cau

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn And9gcshpejt6qqxvh G4ezldxrm9e40s2m6mnvtgtgvecvth5kbmkme Usqp Cau

- Student Loan Interest Deduction Calculator Student Loan Hero

Find, Read, And Discover Claiming Student Loans On Income Tax, Such Us:

- Student Loan Interest Can You Deduct It On Your Tax Return

- Tax Penalty Hits Student Loan Borrowers In Income Driven Repayment Plans For The First Time The Institute For College Access Success

- How To Claim A Student Loan Interest Deduction Thestreet

- Stop Tax Refund Garnishment Over Defaulted Student Loan Debt By Pleasantbarrel567 Issuu

- Calameo Child Tax Credit

- Student Loan Forgiveness And Other Ways The Government Can Help You Repay Your Loans Ed Gov Blog

- Student Loan Interest Can You Deduct It On Your Tax Return

- Aurora Loans Seattle Wa

- How Many Payday Loans Can I Have In Indiana

- Home Loans Internet Banking

- Bfs Loans Requirements

- Can A Debt Management Plan Help With Payday Loans

- Instant Cash Payday Loans Bad Credit

- Payday Loans Tara Blvd

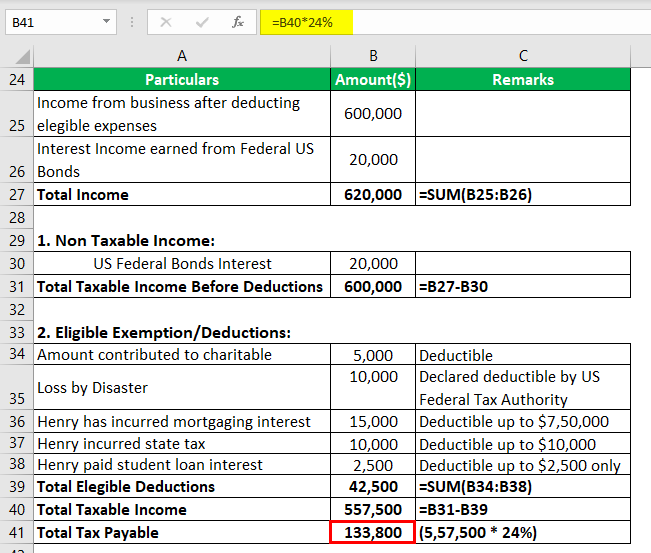

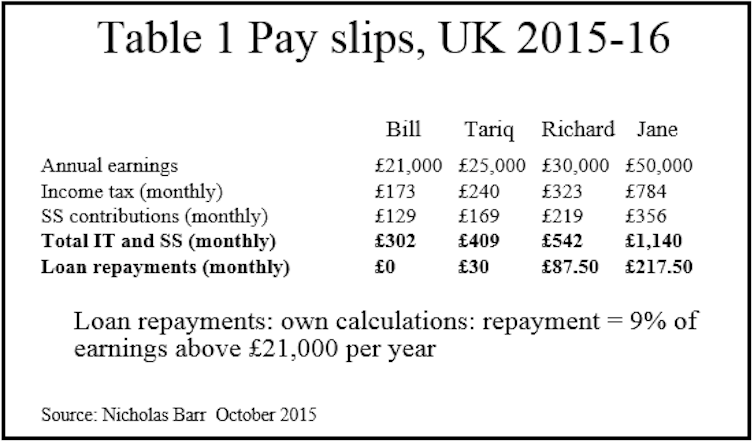

But a 2000 deduction can bring your taxable income down to 38000. The irs considers forgiven student loans taxable income per 26 usc 61 a 12 cornell law school. You may claim those credits by entering the amount of your student loan interest on line 5852 of your provincial income tax return while quebec residents will apply this amount to line 385 of their tp1.

If you are searching for Payday Loans Tara Blvd you've arrived at the ideal place. We ve got 104 graphics about payday loans tara blvd including pictures, photos, pictures, backgrounds, and more. In such page, we additionally provide variety of images out there. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, translucent, etc.

The deduction is calculated based on the amount of interest you paid over the past year as well as your income and tax bracket.

Payday loans tara blvd. If the student is currently making interest only payments he may qualify to deduct those payments as. However he can claim the interest he paid on the student loans as a deduction through the year. If youre single and make 40000 a year all of it is subject to taxes.

To claim the non refundable tax credit for student loan interest. Because this is a tax deduction and not a credit it reduces. The income phaseouts in 2021 are 70000 to 85000 single and 140000 to 170000 married filing jointly.

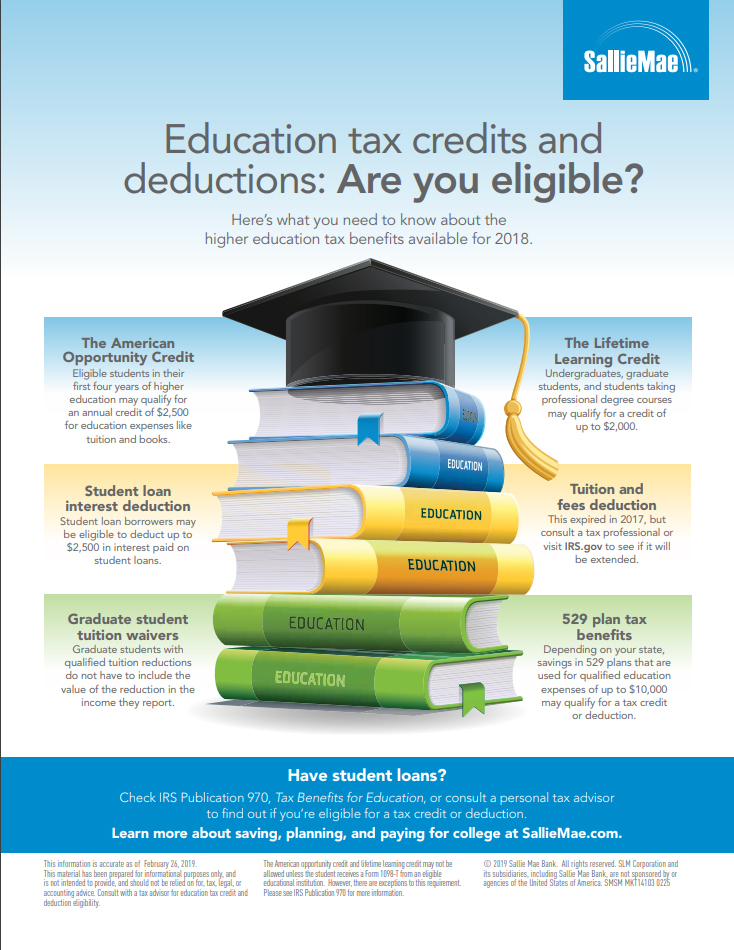

Student loans are not considered income when filing taxes. Claim any corresponding provincial or territorial credits. The american opportunity tax credit aotc is for first time college students during their first four years of higher education.

While the student loans eligible for the tax credit are administered by the federal and provincial governments theyre issued through regular banks and other lending sources. The answer is unfortunately yesin some situations. Enter the amount of eligible interest you paid on line 31900 of your income tax return.

You enter this amount on your tax return. Its important to understand that even though you can claim up to 2500 as a student loan deduction the actual amount saved on your taxes wont be that much. The credit is 100 of the first 2000 of qualified education.

The student loan interest deduction allows you to write off up to 2500 per year from your taxes in student loan interest payments. A college student does not need to report student loans received as part of his taxes. The student loan interest deduction reduces your taxable income based on how much interest you paid on top of your student loan principal payments.

The student loan interest deduction can be claimed for an unlimited number of years. Your lender will send you an annual statement reporting the interest amount on your loan. The student loan interest deduction is a federal income tax deduction that allows you to subtract up to 2500 in the interest you paid on qualified student loans from your taxable income.

The canceled debt amount has to be reported on an irs form 1099 c irsgov instructions if its more than 600.

More From Payday Loans Tara Blvd

- Dream Street Home Loans Review

- Auto Loans Macon

- Businesses That Wish To Get Loans

- Brad Evans Loans

- Bad Credit Car Loans Bc Canada

- How To Get Stafford Loans Forgiven

- Housing Corporation Loans

Incoming Search Terms:

- Married Filing Separately For Student Loans Student Loan Planner Housing Corporation Loans,

- Stop Tax Refund Garnishment Over Defaulted Student Loan Debt By Pleasantbarrel567 Issuu Housing Corporation Loans,

- College Students Are You Getting Your Education Tax Credits The Official Blog Of Taxslayer Housing Corporation Loans,

- How To Deduct Student Loan Interest From The Taxable Income Recover Unclaimed Tax Refunds From Cra Personalbanker Housing Corporation Loans,

- Pay Off Student Loans Faster Learn More Cash Factory Usa Housing Corporation Loans,

- How To Get The Student Loan Interest Deduction Nerdwallet Housing Corporation Loans,

- Student Loans Interest Deduction Archives Tuition Io Housing Corporation Loans,

- How Much Student Loan Interest Is Deductible Payfored Housing Corporation Loans,

- 4 Student Loan Tax Tricks Housing Corporation Loans,

- Get link

- X

- Other Apps