- Get link

- X

- Other Apps

Can Irs Take Taxes For Student Loans, Year Round Tips To Make Tax Time Easier And Safer Regions

Can irs take taxes for student loans Indeed lately is being hunted by users around us, perhaps one of you. Individuals now are accustomed to using the net in gadgets to view image and video information for inspiration, and according to the name of the post I will discuss about Can Irs Take Taxes For Student Loans.

- Why Deducting Your Student Loan Interest Is A Scam By John Cook Educated And Broke Medium

- How Can I Fill Out A Fafsa Without A Tax Return H R Block

- A Huge Tax Bill Is The Downside Of Student Loan Forgiveness Student Loan Planner

- How Long Does It Take To Get A Tax Refund Smartasset

- I Owe The Irs Money What Happens If I Get A Tax Refund

- The Morally Suspect Way The Government Collects Student Loans During Tax Season Marketwatch

- Did You Consolidate A Student Loan You Can Probably Get A Deduction On Your Taxes For Student Loan Interest Paid Doctored Money

- Student Loan Debt Can Affect Your Taxes In A Few Different Ways Business Insider

- How To Stop Student Loans From Taking Your Tax Refund Nerdwallet

Find, Read, And Discover Can Irs Take Taxes For Student Loans, Such Us:

- Tax Penalty Hits Student Loan Borrowers In Income Driven Repayment Plans For The First Time The Institute For College Access Success

- What Is A Cp05 Letter From The Irs And What Should I Do

- Biden Cancels Student Loans Can Work Pay For Loans Cares Act Wusa9 Com

- Is My Student Loan Tax Deductible The Turbotax Blog

- Can The Irs Take Or Hold My Refund Yes H R Block

- How Can I Fill Out A Fafsa Without A Tax Return H R Block

- American Education Services Account Access

- Fort Lee Credit Union Loans

- Department Of Education Defaulted Loans Contact Number

- Paying Interest On Student Loans While In Deferment

- Quick Loans Wichita Ks

- Leap Auto Loans

- Camden Home Loans

- Home Loans For Foreigners In South Africa

If you default on a student loan the irs can confiscate income until the student loan is paid in full. Can the irs offset my taxes for private student loans. But refunds arent currently being seized for taxes filed after march 13 or for.

If you are looking for Home Loans For Foreigners In South Africa you've arrived at the ideal location. We ve got 104 images about home loans for foreigners in south africa adding pictures, photos, pictures, wallpapers, and much more. In these webpage, we additionally have number of images out there. Such as png, jpg, animated gifs, pic art, logo, black and white, translucent, etc.

It is absolutely legal for the government to take your tax refund after youve defaulted on federal student loans.

/student-loan-interest-deduction-3193022_v1-afb591a7f65b4c5186b62def66cfa083.gif)

Home loans for foreigners in south africa. Having a student loan tax offset doesnt directly impact your credit. However when it does do so it can collect up to 15 of your disposable income. They can also garnish your wages take some of your social security benefits and deny you future federal financial aid.

2018 39 to taxpayers who took out federal and private student loans to finance attendance at nonprofit or other for profit schools not owned by corinthian college inc. In fact it can help your credit if it helps you get out of default. An interception of tax refunds is a popular method of collection and the department of education collects millions using this method.

Does a student loan tax offset affect my credit. When you make monthly payments to your student loans it includes your principal payment as well as your interest payment. Whether you have private or federal student loans the student loan.

Of education they may take your tax refund to pay towards your loan balance. If your student loans are in default and your lender has submitted them to the dept. If your wages are being garnished to recoup a student loan debt odds are that the debt is not a federal loan but a.

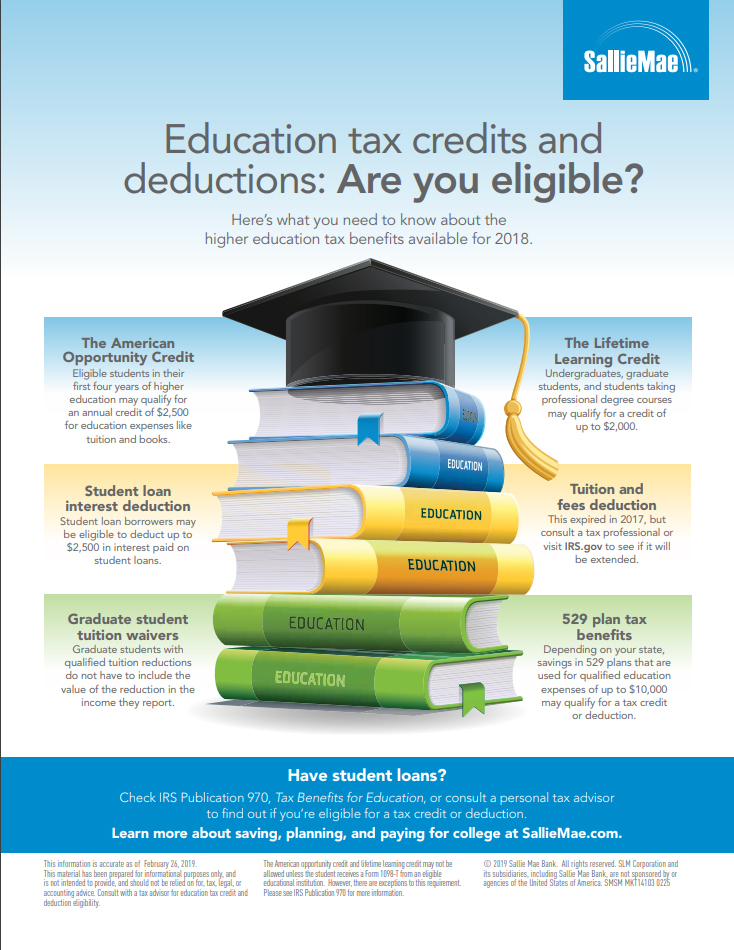

The treasury department and the irs have determined that it is appropriate to extend the relief provided in rev. The internal revenue service irs has issued guidance for some taxpayers who took out federal or private student loans to finance attendance at a nonprofit or for profit school. You may be able to deduct all or part of your student loan payments on your federal income tax returns.

The irs and the treasury department cannot use your tax refund to repay private loan debt. Usually your loan holder can take your state and federal tax refunds if you default on federal student loans. Federal benefits can also be confiscated.

Call 800 304 3107 and use the automated system to see if you have a tax refund offset.

More From Home Loans For Foreigners In South Africa

- Lending Account Loans

- Private Loans Come From

- Easy Payday Loans Australia

- Commercial Loans Adelaide

- Apply For Income Based Repayment Plan For Student Loans

- Litton Home Loans

- Banks With Low Interest Rates For Loans

Incoming Search Terms:

- What Is A Cp05 Letter From The Irs And What Should I Do Banks With Low Interest Rates For Loans,

- Graduate From Your Student Loans Nagdca Banks With Low Interest Rates For Loans,

- Irs Advises Planning Ahead When Requesting Tax Transcripts For Mortgages Student Loans Banks With Low Interest Rates For Loans,

- Irs Offers Tax Relief For Student Loan Debt Discharges Accounting Today Banks With Low Interest Rates For Loans,

- Stimulus Check 2020 Delays Issues Tax Return Amount Ksdk Com Banks With Low Interest Rates For Loans,

- A Huge Tax Bill Is The Downside Of Student Loan Forgiveness Student Loan Planner Banks With Low Interest Rates For Loans,

- Irs Audit Letter Cp2501 Sample 1 Banks With Low Interest Rates For Loans,

- Where S My Refund Check Irs Refund Status Liberty Tax Banks With Low Interest Rates For Loans,

- Stop Tax Refund Garnishment Over Defaulted Student Loan Debt By Pleasantbarrel567 Issuu Banks With Low Interest Rates For Loans,

- Get link

- X

- Other Apps